15+ 250000 mortgage

6 if your loan period is more than 15 years. The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan.

Stats Eli Residential Group

However if you are not ready for a 15-year mortgage you may opt for a longer term.

. Thats about two-thirds of what you borrowed in interest. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. The average APR on a 15-year fixed-rate mortgage rose 3 basis points to 5433 and the average APR for a 5-year adjustable-rate mortgage ARM fell 3 basis points to 5404 according to rates.

Account for interest rates and break down payments in an easy to use amortization schedule. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. The upfront mortgage insurance.

Long 50 years plus. Although mortgage servicers often collect escrow tax and insurance TI these accounts are separately maintained and. But no more than 15 years.

The exclusion is increased to. And has an existing mortgage balance of 250000. Use our free mortgage calculator to estimate your monthly mortgage payments.

Todays national 15-year mortgage rate trends. A 15-year loan for 250000 at 4 interest has a. Interest rate APR 38.

Extension of the exclusion of canceled or forgiven mortgage debt from income. The standard deposit insurance amount is 250000 per depositor per insured bank for each account ownership category. ASCII characters only characters found on a standard US keyboard.

Your total interest on a 250000 mortgage. An advance-fee scam is a form of fraud and is one of the most common types of confidence tricksThe scam typically involves promising the victim a significant share of a large sum of money in return for a small up-front payment which the. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

The problem comes when it is used in roofs and lofts where it has a tendency over time for the foam to trap moisture around wooden joints which leads to. Their current mortgage. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

Must contain at least 4 different symbols. Find your happy Search properties for sale and to rent in the UK. Loan 30-Year Fixed Mortgage 15-Year Fixed Mortgage Difference.

19-0000 Life Physical and Social Science Occupations. In the UK and US 25 to 30 years is the usual maximum term although shorter periods such as 15-year mortgage loans are common. 30 year mortgage of 4 on 250000 loan.

You may exclude the first 250000 of gain from the sale of your home from your income and avoid paying taxes on it. Includes fixed 15-year mortgage rates for conventional FHA and VA loans plus tips to find your best interest rate. Set us as your home page and never miss the news that matters to you.

The mortgage is secured by his home. You can use the following calculators to compare 15 year mortgages side-by-side against 10-year 20-year and 30-year options. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage.

25-0000 Educational Instruction and Library Occupations. FHA MIP chart for. 15-0000 Computer and Mathematical Occupations.

You cant suspend the 5-year period for more than one property at a time. Web-magazine integrating news with a touch of insight perspective and wit. Last week President Biden laid out a sweeping plan to cancel up to 20000 in federal student loan debt per borrower.

You can revoke your choice to suspend. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. How much is FHA mortgage insurance.

While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. Once youve saved enough funds and increased your credit score you may qualify for. Mortgage insurance is an.

21-0000 Community and Social Service Occupations. Streamline refinances and some simple refinances 001 UFMIP Hawaiian home lands 2344 to 380 UFMIP depending on the loan term Indian lands. This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home.

6 to 30 characters long. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

To get that maximum individuals must earn less than 125000 a year or less. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. If you meet certain conditions you may exclude the first 250000 of gain from the sale of your home from your income and avoid paying taxes on it.

Is insured separately for up to 250000. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. To get the new loan he had to pay three points.

For today Wednesday September 21 2022 the national average 15-year fixed mortgage APR is 5720 up compared to last weeks of 5560. Mortgage payments which are typically made monthly contain a repayment of the principal and an interest element. Around 250000 UK homes have spray foam insulation where foam is applied using powered sprayers which then expands and turns to a solid coating to insulate roofs lofts walls and floors.

A 15-year mortgage costs you less since the total interest paid is less than a 30-year but there are both pros and cons to a 15-year loan. The 175 UFMIP applies to most FHA loans no matter the loan amount or term except for the following. In 2021 Bill refinanced that mortgage with a 15-year 100000 mortgage loan.

17-0000 Architecture and Engineering Occupations. Canceled or forgiven mortgage debt later. Either your loan amount is 250000 or less or the number of points isnt more than.

4 if your loan period is 15 years or less.

Stats Eli Residential Group

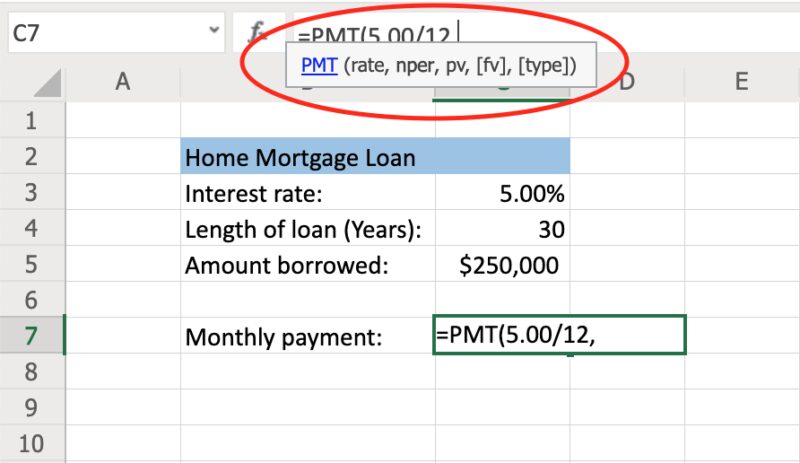

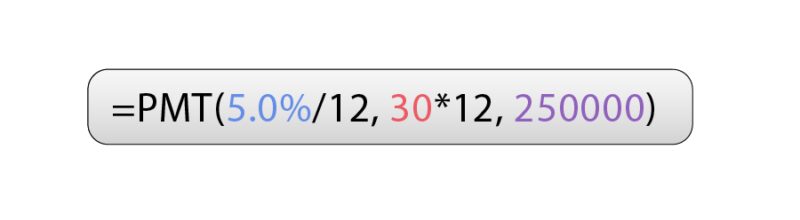

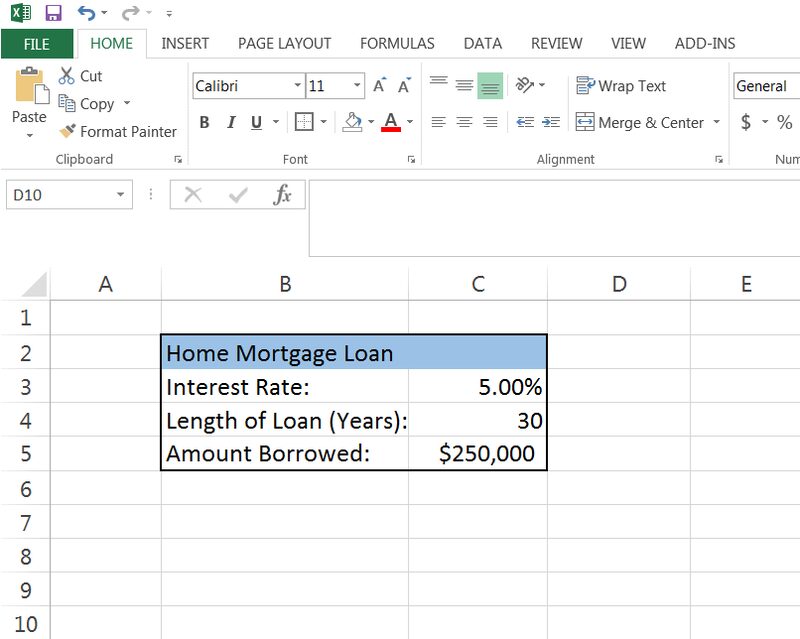

How To Calculate Monthly Loan Payments In Excel Investinganswers

Sue Schlicker Qa Analyst Iii United Wholesale Mortgage Linkedin

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

What Is Mortgage Life Insurance

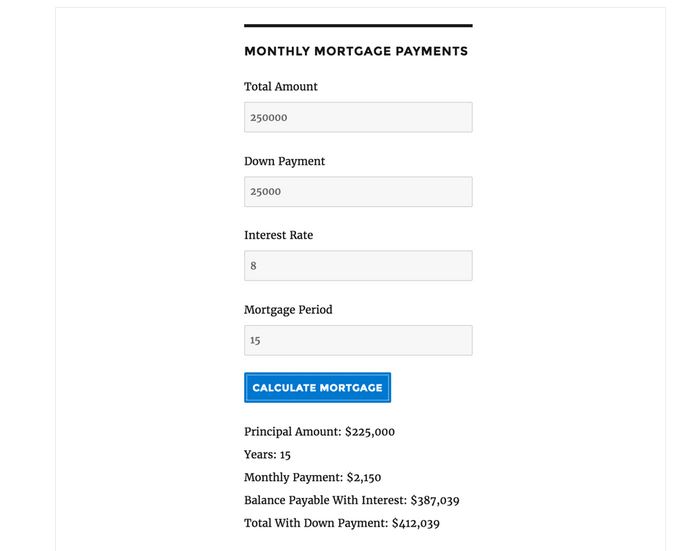

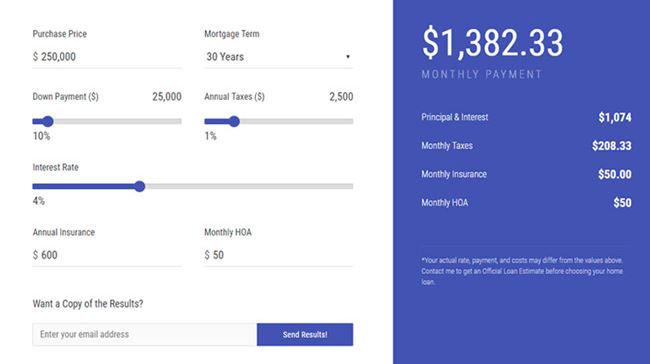

4 Real Estate Calculator Plugins For Wordpress Wp Solver

Here S A Budget Breakdown Of A Couple That Makes 500 000 A Year And Still Feels Average Make It Money

How To Calculate Monthly Loan Payments In Excel Investinganswers

Top Tax Deductions For Second Home Owners

Loan Interest Calculator How Much Will I Pay In Interest

How To Calculate Monthly Loan Payments In Excel Investinganswers

Cdata Jpmorgan Chase Co 2012 Investor Day Presentation Slides

4 Real Estate Calculator Plugins For Wordpress Wp Solver

Primary Residence Definition And Impact Rocket Mortgage

Definitions Of A Middle Class Income Consider Yourself Middle Class

Mortgage Protection Insurance For Seniors 2022 Update

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be