Depreciation equation calculator

Depreciation Amount Asset Value x Annual Percentage. The basic way to calculate depreciation is to take the.

Depreciation Formula Calculate Depreciation Expense

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

. Calculate the revised depreciation. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. It has a useful life of 10 years and a salvage.

After two years your cars value. You can use the following basic declining balance formula to calculate accumulated depreciation for years. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Depreciation Per Year is calculated using the below formula.

Company ABC bought machinery worth 1000000 which is a fixed asset for the business. Depreciation is a method for spreading out deductions for a long-term business asset over several years. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

This free downloadable PDF is fantastic for calculating depreciation on-the-go or when youre without mobile service to. Total yearly depreciation Depreciation factor x 1. Total Depreciation - The total amount of depreciation based upon the difference.

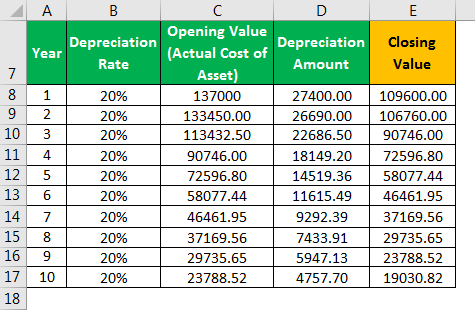

Calculate the revised depreciation and make the journal entry for revised depreciation in year 3 and year 4. Our car depreciation calculator uses the following values source. Depreciation Per Year Cost of Asset.

DOWNLOAD THE CLAIMS PAGES DEPRECIATION GUIDE. Depreciation formula The Car Depreciation Calculator. Periodic straight line depreciation Asset cost - Salvage value Useful life.

After a year your cars value decreases to 81 of the initial value. Depreciation Original cost Residual Value x frac. Here is the step by step approach for calculating Depreciation expense in the first method.

Depreciation x Actual output during the year units Sum of Years of Digits method It is a variant of the diminishing balance method. Accumulated Depreciation Formula Example 1. As the truck has been used and.

Calculate the depreciation to be charged each year using the Straight Line Method. This is the cost of the fixed asset. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Depreciation Calculator Depreciation Of An Asset Car Property

Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula And Calculation Excel Template

Accumulated Depreciation Definition Formula Calculation

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Calculator

Depreciation Formula Examples With Excel Template

Depreciation Calculator Definition Formula

Depreciation Rate Calculator Store Save 45 Countylinewild Com

Depreciation Calculator Property Car Nerd Counter

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Formula And Calculation Excel Template

Sum Of Years Depreciation Calculator Template Msofficegeek

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense